In this article we discuss how to file your U.S. Federal Income taxes for your vacation property using H&R Block tax software.

Do you have an LLC or company registration created for your rental property activity? If the answer is Yes, then you need to use IRS form Schedule C – Profit or Loss From Business instead of Schedule E.

It very well could also be that the rental activity is part of a larger business providing other services/products. We will not cover any other activity but the rental activity in this introductory walk through.

If you prefer a video walk through, check it out below.

In preparing this article, there are few assumptions made to simplify the walk through. It could be the case that your situation has different circumstances. If you need help, please ask in the comments below or contact us directly in the About Us Page.

| Assumptions Made For This Vacation Property * Property is owned/rented 100% throughout the filing year. * You have a company/LLC formed for your activity. * You materially participate in your rental activity. * The owner doesn’t employ any help. |

The following table of contents is a quick guide to the topics discussed in this walk through.

Table of Contents

First Question…Check Your Filing Status

Before you get started, please first check your filing status. Attached below is a document that summarizes the tests for Material Participation. In this walk through we assume that you are filing under Material Participation status.

Here is a quick version to use:

- You managed all the rental activity and did not pay anyone else management fees.

- The activity required 10 hours/week of your time.

- You made all the decisions in the maintenance/upkeep of the properties.

Tabulate Your Income/Expenses First

There is a companion article Financial Information Needed to File A Tax Return For Your Vacation Property – Schedule C . In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation of expenses and income.

This article is a good start to prepare your tax return for your vacation rental property.

Starting the Software

H&R Block has both PC/Mac software installations as well as cloud versions of the same software. Any of these versions will do. In this demo, we are using the Deluxe version. The Deluxe version, while not specifically targeted to real estate investors, is perfectly adequate for the job.

Where to Start…

You will want to navigate to the ‘Your Own Business’ section of the software. At the top, click on ‘Take Me To’ and select ‘Your Own Business – Schedule C’, hit the ‘Go To’ Button.

Once on the ‘Your Own Business’ page, click ‘Add Business’. You will get a description page for the business.

Enter the following information:

- Enter the business name, address and description.

- Select ‘Real Estate’ for category and 531310 as the business code.

- The EIN would be needed if your business has registered with a government, e.g., to pay employees. We assume not here, so leave it blank.

Business Details…

Next, you need to specify some business details.

In the screen ‘Tell us if these applied to your business in 2019’, you may need to click ‘I started it or acquired it’. Leave all the other unchecked. The next screen asks about ‘Cash Accounting Method’, select ‘Yes’.

After that selection, select ‘Yes’ in the screen that asks about ‘Material Participation’.

Entering Your Rental Income

Income is entered in two distinct places. First case, a third party such as a Rental Marketplace sent you a 1099-MISC. In the second case, you earn income from everywhere else that wasn’t reported using a 1099-MISC.

For each 1099-MISC, create an entry in the ‘Miscellaneous Income’ page.

Note that the income reported on these 1099s should come from third parties who book rentals and collect payments on your behalf. You must still manage the rental activity and not have another party do that task. Otherwise, you will not be able to file as business rental activity.

Skip the next page that covers 1099-K income.

In the next page, enter all other income from every other source. Sum it all up and enter it into the ‘Total receipts and sales’ box. Note that total income includes all the money collected from guests, including rent, commissions paid and sales/use taxes.

Skip over the next screens that talk about 1099-PATR, Other Income and Returns/Allowances.

Home Office Expenses

If you use an office for your rental activity you may claim a deduction. The most common case is that you have a room in your house that is used to conduct your business. We will cover the common case and use the simplified deduction available by measuring square footage of the office versus the home.

First confirm these questions.

Enter ‘No’ for the question about if you used your home for licensed daycare. Next enter if you own or rent your home.

Select ‘Simplified Deduction’ in the next screen. We assume that you do not spend enough time or have enough rental business to justify an itemized expense entry.

Enter square footage amounts for your home and office.

Next, enter the percentage of time your rental activity was conducted in the office. If you spent all of your time in the office when working your rental activity, enter ‘100%’. Skip the next screen for assets sales (uncommon) and jump to the summary.

Vehicle Expenses

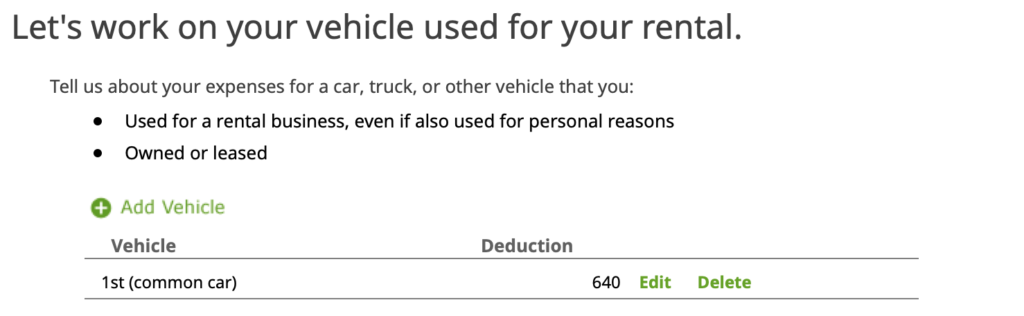

If you used a vehicle to travel to the rental property, you can claim a deduction. We will consider the simplest case, you used your personal vehicle part of the time and you are claiming the Standard Mileage deduction. Click next to enter the section vehicle use. Select ‘Add Vehicle’.

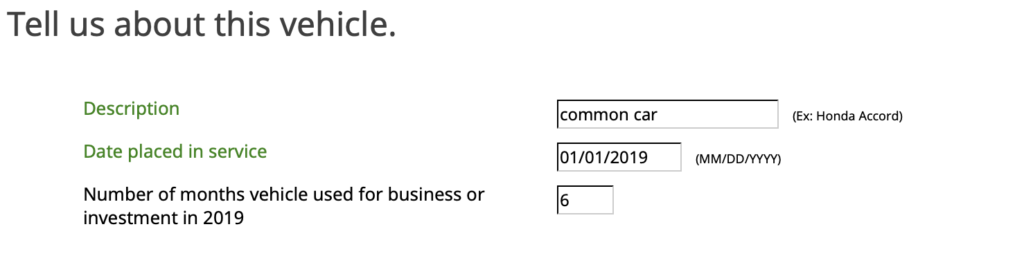

In the first screen ‘Tell us about this vehicle.’, enter the details of the vehicle.

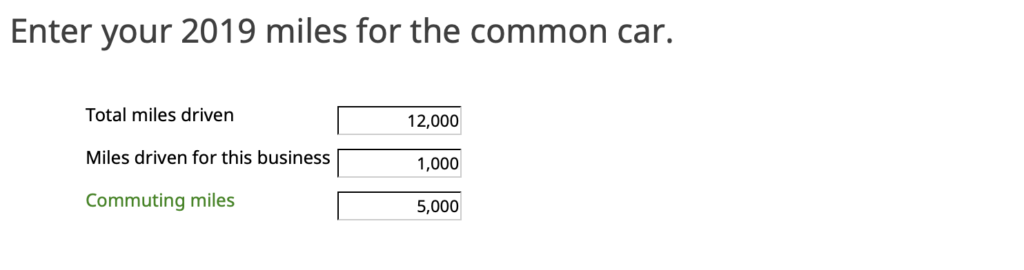

Next, enter the miles driven for the vehicle. The important entry here is ‘Miles driven for this business’ – this is the mileage you drove to the rental property and other trips on its behalf. In the next screen, select ‘Standard mileage’.

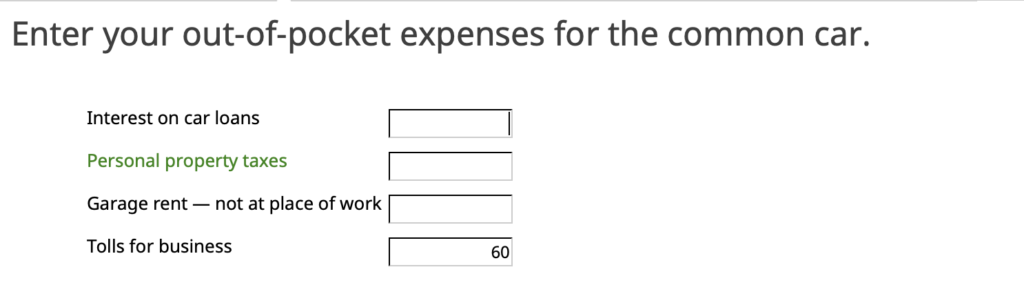

The next page enter ‘Out of pocket expenses’. The last two, ‘Garage Rent’ and ‘Tolls’ will not be captured in your Standard Mileage deduction. So, you will get a higher deduction if you can claim those expenses. The other two, ‘Interest on car loans’ and ‘Personal property taxes’ are only relevant if you are itemizing actual expenses (which we are not doing in this demo – using Standard mileage deduction).

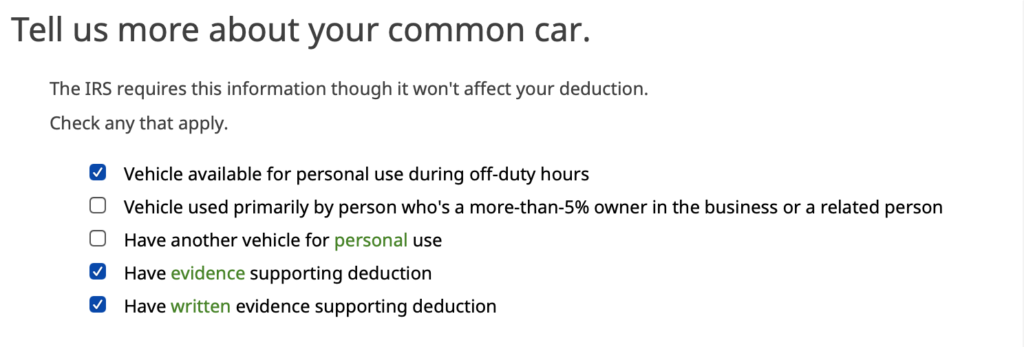

In the last screen ‘Tell us More’, enter more information about the vehicle. We suggest checking the boxes indicated here. It is a good practice to keep evidence of your travel. Click the check-boxes indicating that you will provide evidence for your deduction.

Depreciate The Property

Large purchases of property that you buy along with the rental will be depreciated each year of service. For this video, we will start with the depreciation of the rental property itself.

At the depreciation page, enter ‘Add a Property’. In the entry screen fill out each field. Specify that the property type is ‘Residential rental real estate’.

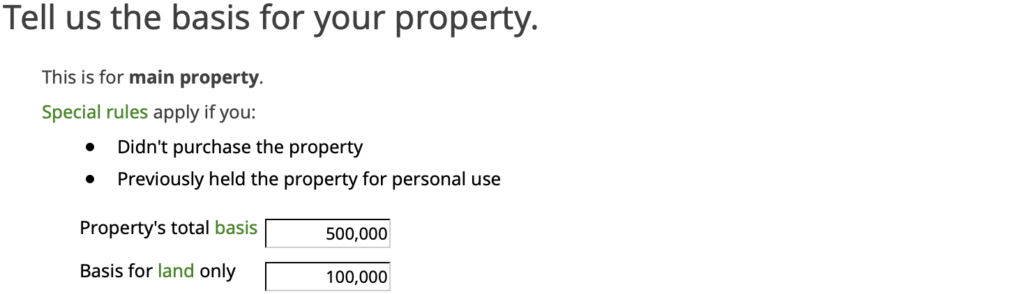

In the next screen enter the financials for the property. The actual depreciated value will be the difference between your purchase price and the land value entered.

Enter Rental Expenses

The next page provides a place to enter your rental expenses. It helps to prepare this ahead of time so that the entry of the numbers is quick and easy. There is a companion article Financial Information Needed to File A Tax Return For Your Vacation Property – Schedule C. In that article, instructions as well as a pre-formatted spreadsheet are provided to assist in the tabulation.

In the screen below check off all the entries that are relevant for you rental activity. The entries checked in the image are very common.

In the first screen enter an Advertising costs.

Next, enter commissions.

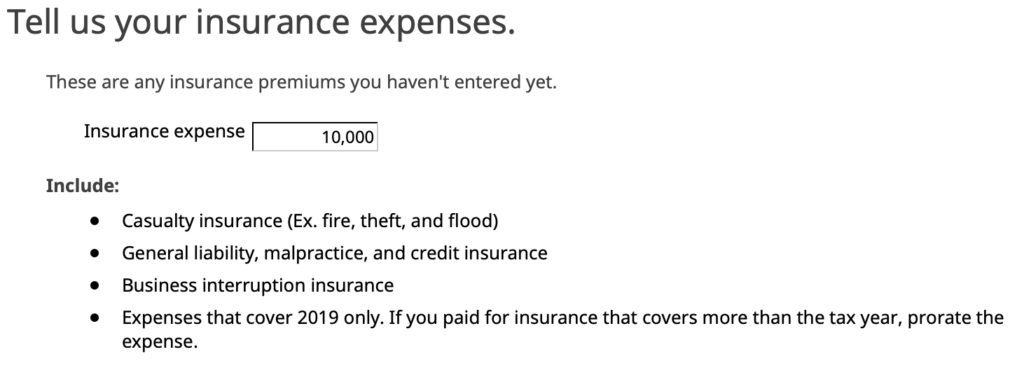

Enter insurance, typically costs for property fire/flood insurance.

If you paid an legal fees, such as a title search, enter them here.

Click to the next page to enter ‘Mortgage Interest Expenses’. There are two components here. The first is interest reported in Form 1098 that your mortgage holder sent you. The second component is other Mortgage Interest not in the Form 1098. You would enter financials in these boxes if there were other interest payments not specified in the Form 1098. If you prepaid these amounts during your closing enter them here. This is very common.

If you paid points for your mortgage, add them into your total interest expenses.

In the next screen, enter any other expenses that are not captured elsewhere. The example provided here is Condo Association Fees.

For your repair/maintenance expenses, include repair costs as well as cleaning expenses.

Enter supply costs.

Enter any taxes. These are typically sales/use taxes on rentals and property taxes.

Lastly enter utility expenses. Here is your expense summary.

Summary

You have just completed the entry in your tax return for a vacation rental property. After complete, review the filled out form by going to ‘Forms’ at the top of the page and selecting ‘Schedule C’.